16 Minute Training Reveals:

How To Get A Six-Figure Tax-Free College Refund Through A Little Known Legal Loophole

You’ll Discover…

How You Can Pay For College While Allowing Your Money To Grow With Uninterrupted Compound Interest.

How You Can Have Returns Tied To Market Performance While Having A Guarantee That You’ll Never Lose Money.

How To Get The Money You Save For Your Children’s College Education Back Tax Free.

16 Minute Training Reveals:

How To Get A Six-Figure Tax-Free College Refund Through A Little Known Legal Loophole

You’ll Discover…

How You Can Pay For College While Allowing Your Money To Grow With Uninterrupted Compound Interest.

How You Can Have Returns Tied To Market Performance While Having A Guarantee That You’ll Never Lose Money.

How To Get The Money You Save For Your Children’s College Education Back Tax Free.

Discover How The Hill’s Are Getting A $480,000 Tax-Free College Refund

Jim Hill, 58, and Marie Hill, 56, live in the Chicago suburbs. Jim is a software engineer with Microsoft making $370,000 per year and Marie has a small business that makes about $20,000 per year.

They have two children, Mathew, who’s a senior in high school, and Anna Marie, who’s a junior in high school. They were planning on college costing $250,000 for each child and they are planning to pay for all of their children’s college costs.

They had $40,000 saved for each child in 529 Plans and they were planning to pay for the rest by cashing in Jim’s company stock.

Challenge:

Jim wasn’t excited about the idea of having to cash in the company stock he’d worked his entire career for along with paying capital gains taxes as well. He also thought he didn’t have enough time to build a College Refund plan given that his oldest son was already a senior in high school.

Solution:

We worked with them to take out a margin loan against Jim’s stock. This allowed them to keep the value and future growth of Jim’s stock while also accessing cash to fund their plan without paying capital gains taxes.

He’s now set up to take out $100,000 per year for the next 5 years, $500,000 total. This is enough for them to pay the rest of the children’s college costs and get a $480,000 tax-free refund when they start retirement.

Jim is planning to use this money to pay back his margin loans so he can recapture the full value of his Microsoft stock if it continues to grow.

Discover How The Mehta’s Are Getting A $693,000

Tax-Free College Refund

Family Profile:

Rajen

Age: 50

Income: $227,000

Occupation: Systems Engineer

Jenni

Age: 47

Income: $0

Occupation: Stay At Home Mom

Children:

Seona - 9th Grade - $350k for college and masters.

Asher - 5th Grade - $400k for college and masters.

They were planning to pay the $750k for their children's college educations with savings and with future earned income.

Challenge:

They knew they already had a good amount of the money needed for college saved and they believed they could save the rest as they earned income over the next few years. But they didn’t have a detailed college savings plan in place that they felt confident would help them achieve their goals. They also didn’t like the fact that paying $750,000 for their children's college educations would take a big bite out of their future retirement plans.

Solution:

Put in place a plan where they now know exactly where the money is coming from to pay for college given everything else they need to save and pay for so they feel secure that the children's college educations will be paid for without throwing off their plans for retirement.

College Refund Plan:

Savings: $140,000 per year, $700,000 total

College: $750,000

Projected Tax-Free Refund: $693,000

Discover How The Chaney's Are Getting A $500,000

Tax-Free College Refund

Family Profile:

Teriza

Age: 40

Income: $150,000

Occupation: Accountant

Collin

Age: 42

Income: $80,000

Occupation: Pilot

Children:

Miles - Age 9 - $200,000 for college

Autumn - Age 4 - $200,000 for college

They weren’t sure how they were going to save for college, they didn’t have a plan yet.

Challenge:

Besides not having a concrete plan in place they had never heard of using a life insurance policy as a way to save and pay for college. They were skeptical of how it worked and if they could really actually use it to save for college and get a significant amount of their money back tax-free in retirement.

Solution:

They discovered that every year thousands of parents use these policies to save for college and once they learned exactly how it works, and how it could work for them and their specific situation, they decided that it was the best way for them to achieve their goal of paying for their children's college educations while improving their retirement savings as well.

College Refund Plan:

Savings: $26,400 per year, $264,000 total

College: $400,000

Projected Tax-Free Refund: $500,000

Who We Are

The Parents College Planning Network is an organization created for parents, by parents, with the sole purpose of giving families like yours confidence and peace of mind in how they are going to pay for college.

We understand the struggles facing parents with the rising costs of college education. Our journey began with a simple yet powerful realization: the existing solutions to manage college costs were inadequate and often burdensome. 529 Plans had many drawbacks, like high costs and a high amount of risk still left on the parents' shoulders.

We’ve developed programs for hundreds of families, resulting in the recovery of millions of dollars in college costs. Our organization is dedicated to guiding you through smarter, safer, and more effective strategies for funding your child's education.

Who This Is For

Our College Refund Plan is designed for parents who are planning to spend $100,000 or more out of pocket for their children’s college educations. If you find it hard to swallow the fact that you’ll be spending hundreds of thousands of dollars on your children’s college educations, money that you’ll never see again, a College Refund Plan can help you.

We will help you build a plan where you’ll know exactly how you’ll be paying for college while also getting a substantial refund after your children graduate.

Our strategy is a beacon of hope for parents who can allocate funds for education but seek a smarter way to handle these finances for a better financial future for themselves through the process.

How It Works

Imagine a system where your hard-earned money for your child's education not only serves its primary purpose but also grows, bringing you financial relief in the future. This is the essence of our College Refund Plan.

The plan revolves around a specific type of account that offers tax-free growth and access to your funds. It’s akin to planting a tree where the initial seed (your investment) grows into a sturdy tree (your account), and the fruits (the college funds) can be harvested without harming the tree's continued growth.

This approach is not just about saving; it's about smartly leveraging your funds in a way that benefits you now and in the future. The beauty of this plan is its flexibility and security - it offers protection against market losses, ensures uninterrupted compound interest, and culminates in a substantial tax-free refund.

Whether your child is in kindergarten or high school, it's never too late to start. The plan adapts to your family's timeline, ensuring that your educational and financial goals are met.

OUR EXPERT TEAM

Client Support

Operations

Testimonials

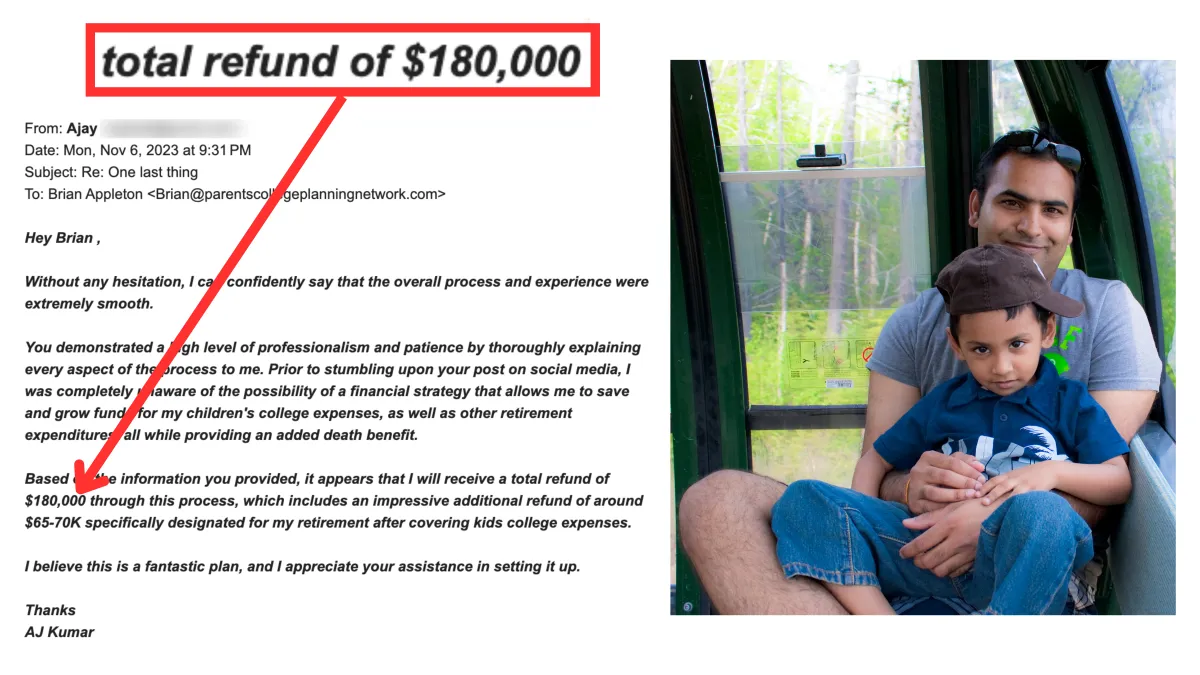

The Kumar Family's $180,000

Tax-Free College Refund

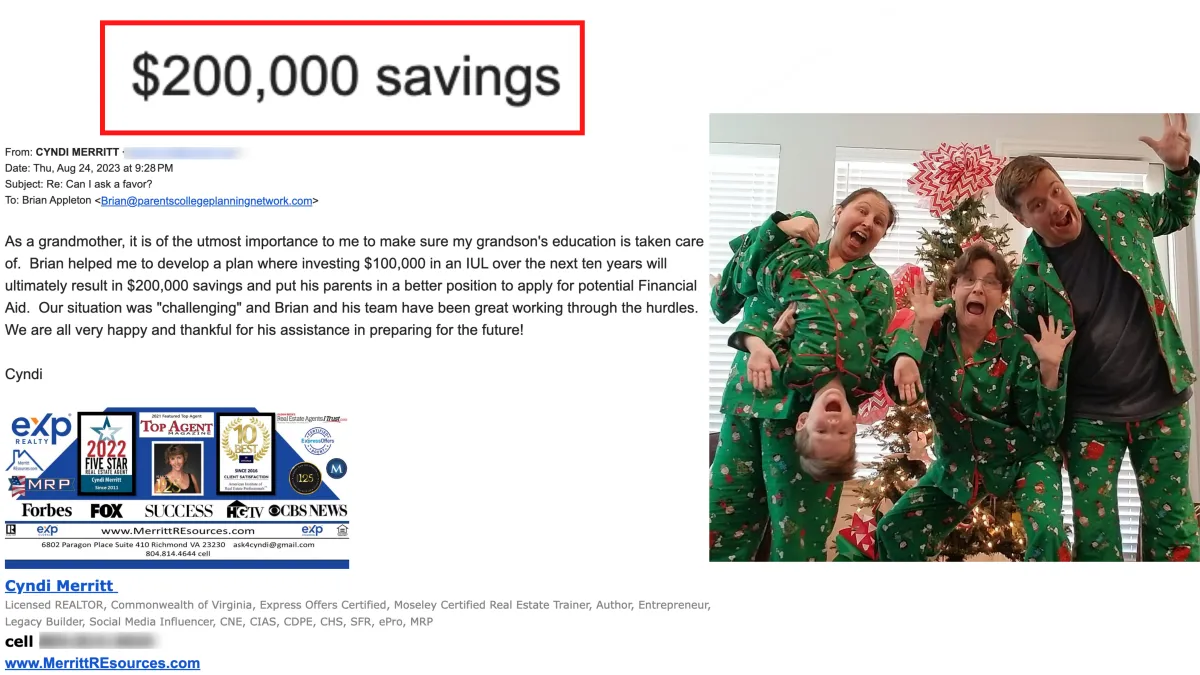

The Merritt Family's $200,000

Tax-Free College Refund

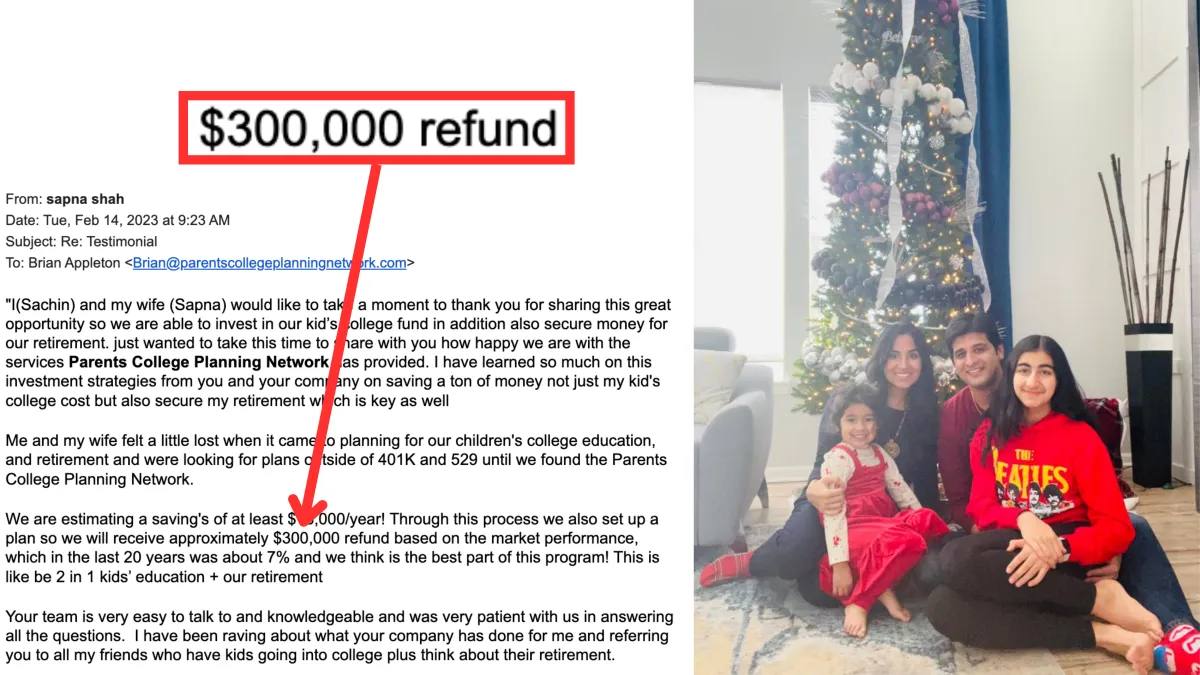

The Shah Family's $300,000

Tax-Free College Refund

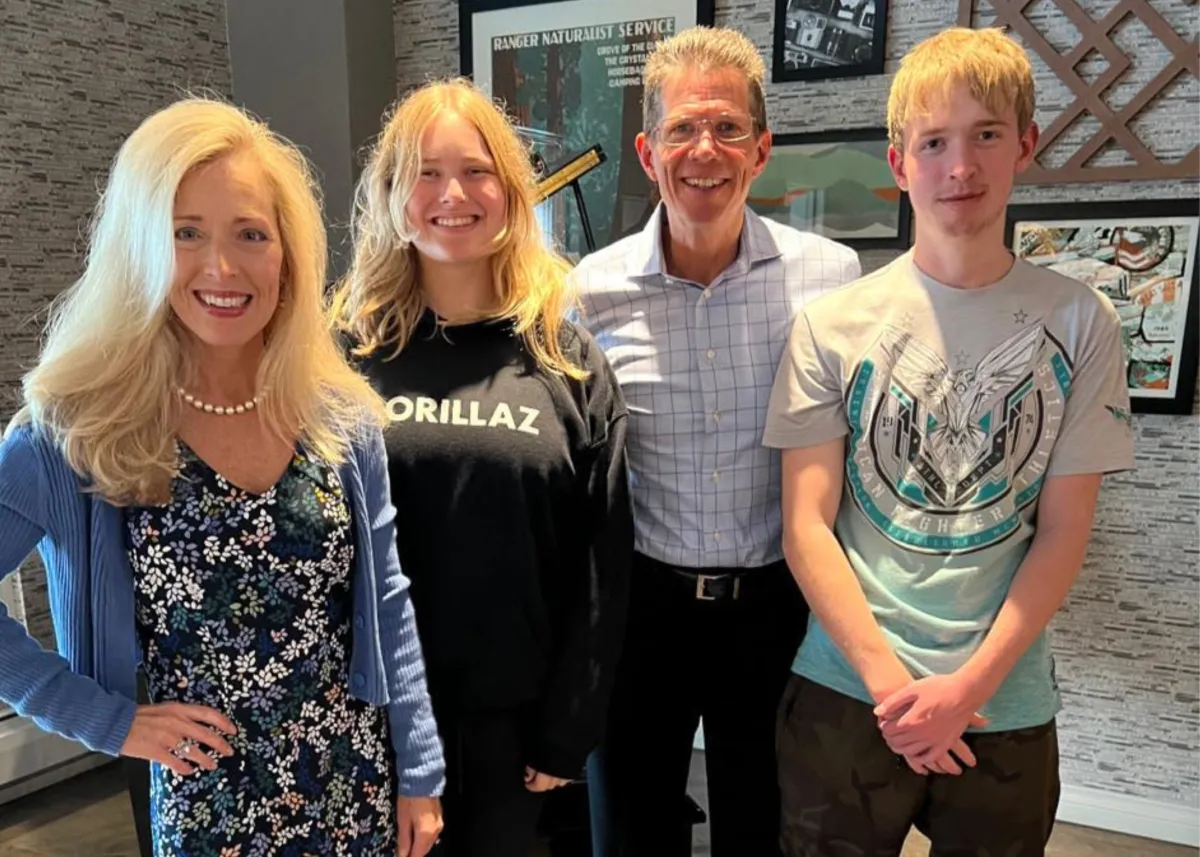

Meet The Founder

Brian Appleton

Brian is the proud husband and father of two wonderful children, Julian and Lennon. He graduated from the University of Iowa with a degree in finance and has been a licensed financial and risk management expert for close to 20 years now.

When he’s not helping clients with their college planning needs he enjoys anything with the outdoors, ultimate frisbee, puzzles and reading a good book.

About The Founder

Brian Appleton

Brian is the proud husband and father of two wonderful children, Julian and Lennon. He graduated from the University of Iowa with a degree in finance and has been a licensed financial and risk management expert for close to 20 years now. When he’s not helping clients with their college planning needs he enjoys anything with the outdoors, ultimate frisbee, puzzles and reading a good book.

FAQS

This seems too good to be true, can I really get a refund?

Yes, you can. We helped hundreds of parents every year with these plans, some of whom you can see on this page. We’re one of a handful of college planning specialists in the country who know how to do this. Thousands of parents have been using these plans for more than 30 years. By using a specific type of account you can get a tax-free refund in retirement while also paying for your children's college educations.To learn more about this account and to get a free assessment of how big your refund could be, visit: ParentsCollegePlanningNetwork.com

Why isn’t everyone doing this?

A lot of people are doing this, so much so that us and our partners are having a hard time keeping up. The truth is this program only works for a small group of parents. You have to be at a certain age with a certain income and you have to be someone who is planning on spending around $100,000 out of pocket to send your children to college. In the whole country there are maybe 10% of people who fit this demographic.

Why haven’t I heard of this before?

Unfortunately old money doesn’t teach new money. The wealthy have been using these plans for decades and they’ve only become available to the rest of us in the last fifteen years. Financial planning isn’t something we sit around the water cooler and talk about on Monday morning, or want to share on a zoom call.Rich universities, the government, and wall street don’t want you to find out about these types of plans either. They’re working hard to initiate you with strategies that make them rich, like 529 Plans, thus most of us are never taught about alternative ways that help reduce risk while getting a benefit for parents in the process.

This has to be expensive, right?

Actually no, it’s not. Whatever amount of money you're planning to spend on college we just stick it into one of these accounts first before going to college and you get the benefit of a tax-free refund in retirement.

How do I know if it will work for me?

This can work for you if you have a newborn and it can work for you if you have a child already in college. We've made these plans work for everyone to achieve your goal of paying for college and getting a six-figure tax-free refund in retirement. You just have to be a parent who’s planning to spend around $100,000 or more to send your children to college.The best way to find out if it’s for you is to watch our short training and get a free assessment of how big your refund could be by visiting: ParentsCollegePlanningNetwork.com

Do I still have time to take advantage of this if my kids are older?

Yes, we’ve built these plans for parents with children of all ages, even kids who are already in college. You just have to be a parent who’s planning to spend around $100,000 or more to send your children to college.

Copyright © 2022+ Parents College Planning Network | All rights reserved worldwide.

Terms Privacy Policy Earnings Disclaimer Terms and Conditions Testimonials and Results Disclosure